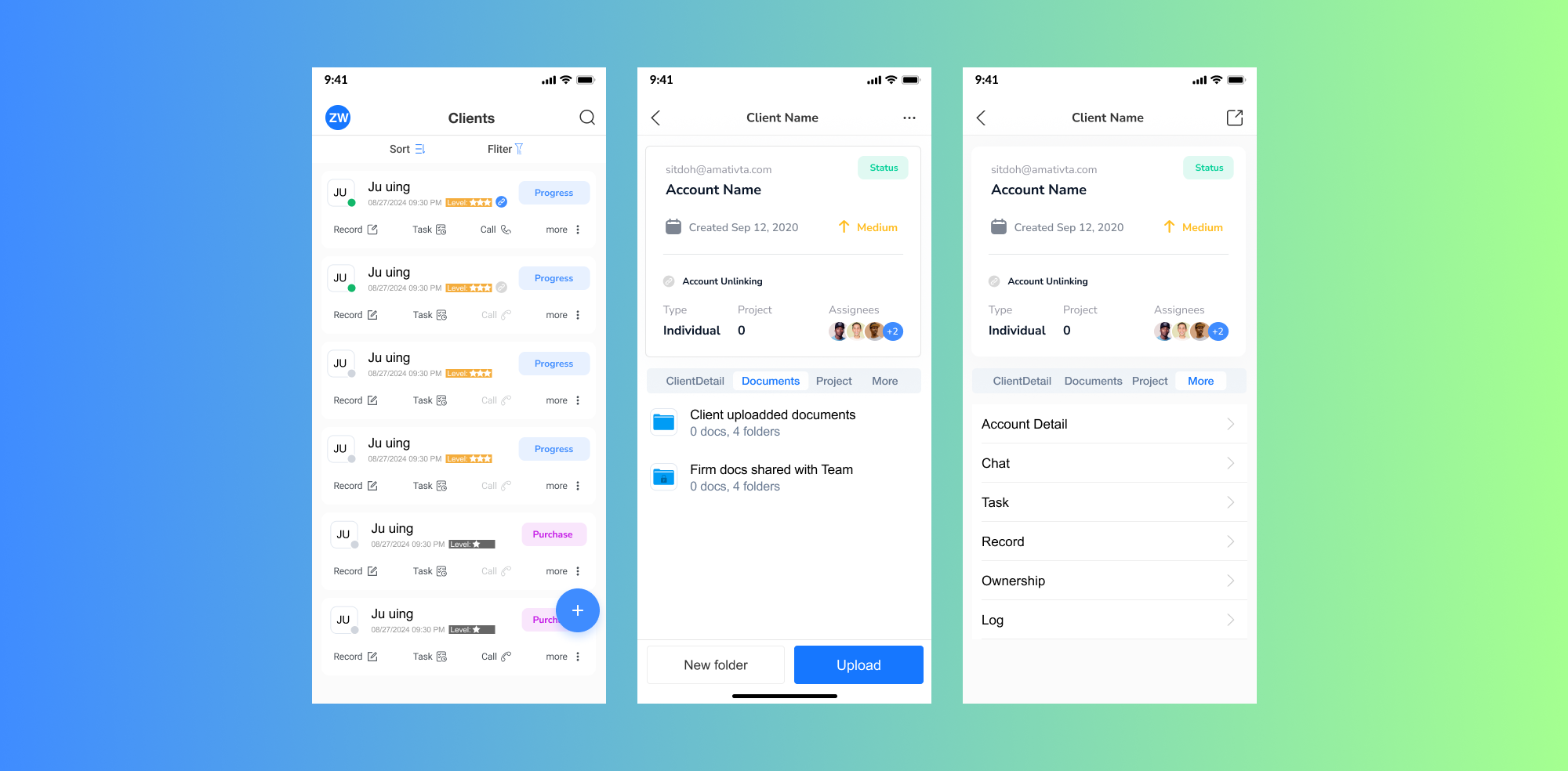

Step 5: CRM & Clients

info

If you are using uTaxes for the first time, please read Welcome to uTaxes, understand and download uTaxes.

1. Managing Clients

1.1 Add Client Accounts

- Navigate to the Clients Tab.

- Click the + Add Client button.

- Fill in client details, such as:

- Name

- Contact information

- Click Save to create the account.

1.2 Edit & Delete Client Accounts

- Select a client from the list.

- To edit:

- Click the Edit icon to modify details.

- To delete:

- Open the client profile.

- Click the Delete button.

1.3 Filter & Search Clients

- Click the Filter button to sort clients by:

- Tags

- Status

- Custom fields

- Use the Search Bar to find specific clients.

2. Managing Tasks

2.1 Add a Task

- Navigate to the Tasks Tab.

- Click the + Add Task button.

- Input task details:

- Task Name

- Priority: High, Medium, or Low

- Assignee

- Deadline

- Add a description if needed.

- Click Save to create the task.

2.2 Update Task Status

- Open a task from the Task List.

- Use the Status Dropdown to change its status:

- To Do

- In Progress

- Done

3. Communication with Clients

3.1 Record Communication

- In the client profile, click Add Record.

- Select the type of communication:

- Call

- Meeting

- Other

- Add a description and click Save.

3.2 Upload & Share Documents

- Open the Documents Section in a client profile.

- Click Upload Document to add files.

- Assign permissions:

- View

- Edit

- Click Save to share the document.

4. Features

-

ClientDetail

- Purpose: Manage client information, including creating, updating, deleting, and reviewing details.

- Key Features:

- Operators can decide whether to sync client information with the tax account.

- Maintain accurate and up-to-date client information.

-

Documents

- Purpose: Manage files shared between the client and the firm.

- Key Features:

- Firms can continuously create and organize folders.

- Firms determine which folders are visible to clients.

- Supports collaborative file sharing for efficient communication.

-

Projects

- Purpose: Create and manage tax-related projects based on the client’s tax situation.

- Key Features:

- Track the progress of tax filing for each client.

- Assign specific tasks and deadlines to ensure timely completion.

-

Account Detail

- Purpose: Display the client’s account information.

- Key Features:

- Operators can only view this section; editing is not allowed.

- Data is available only when the client is linked to the account. If no client is linked, this section remains empty.

-

Chats

- Purpose: Facilitate communication with the client when linked.

- Key Features:

- Operators can chat directly with the client.

- If no client is linked, this section remains empty.

-

Task

- Purpose: Create and manage tasks based on the client’s situation.

- Key Features:

- Assign follow-up tasks to track client progress.

- Prioritize and set deadlines for better task management.

-

Record

- Purpose: Maintain a history of follow-up actions for the client.

- Key Features:

- Record and track client-related activities and follow-up details.

- Helps maintain a consistent log of all client interactions.

-

Ownership

- Purpose: Track ownership changes and transitions for the client.

- Key Features:

- Maintain a detailed record of how client ownership is transferred or managed.

- Useful for accountability and transparency.

-

Log

- Purpose: Provide an operational log of changes to client details.

- Key Features:

- Record all actions performed on the client’s profile.

- Useful for auditing and tracking updates or modifications.